WalletGO

Fintech & Financial

Mobile App Design

Role: Product Designer

Timeline: 4 weeks

Focus: Designing for emotional resilience in financial tracking

74% of Americans live paycheck to paycheck

Most personal finance apps are formed for people who already have financial literacy and surplus income. The market is saturated with tools designed to optimize wealth–not guide people to survive it.

Early-career professionals (22-28) control $2.4 trillion but face financial tools that are complex, shame-driven, and misaligned with their life stage. The market lacks tools that truly meet their needs.

My goal is to design a mobile app to clarify and guide early-career professionals to feel confident and informed when making everyday financial decisions without shame, without complexity, and without assuming they have money to spare.

The Industry Reality

When Users Quit, Money Walks Out the Door

The budgeting and finance app market faces a significant retention challenge. In 2023, the global median day 1 retention rate for finance apps was 20%, dropping to 9% by day 30—meaning nine out of ten users are gone within a month.

Users abandon budgeting apps not due to features, but because the apps make them feel bad about themselves.

Red numbers. Overdraft alerts. "You're over budget" notifications. These are emotional punishments disguised as feedback.

The Research

Building Credibility from the Ground Up

I interviewed six early-career professionals (20–25) managing expenses but lacking consistency. It revealed a clear pattern: they weren’t undisciplined, but every tool made them feel guilty for being human.

One participant kept a physical notebook instead of using apps. When I asked why, she said: "At least the notebook doesn't make me feel bad about myself." They managed expenses monthly, used financial tracking (apps, spreadsheets, notes), and felt frustrated with budgeting or saving. This revealed steady earners still seeking control.

What the Interviews Revealed

Across these conversations, patterns emerged:

The Motivation Problem: Users didn't say "I want a health bar," but they described wanting progress and reassurance without being overwhelmed by numbers.

The Visibility Problem: Users saw numbers in their accounts but couldn't connect those numbers to meaningful patterns or decisions.

The Compliance Problem: Rigid systems (strict budgets, rigid categories) made users feel restricted—so they quit.

Brainstorming

Ruthless Prioritization with MoSCoW With limited time, I couldn't build everything users wanted.

The MoSCoW framework kept me focused:

Must-haves: Budget tracking, spending categories, simple analytics (directly solved core pain points)

Could-haves: Goal setting, social comparisons (deferred to validate core experience first)

Trade-off made: Depth vs. simplicity—users wanted granular controls but were overwhelmed by traditional finance tools, so I prioritized a lightweight MVP with four key categories

Early validation: Created low-fidelity wireframes in Week 2 and ran quick prototype walkthroughs to confirm priorities before investing in polish

Goals & Objectives

Empower early-career professionals confidently manage finances with clarity, motivation, and actionable insights.

This looks like:

Encouraging Consistent Savings Behavior.

Decreasing financial shame as something negative or to avoid.

Help users recognize patterns, set realistic goals, and make informed decisions.

Solving User Problems

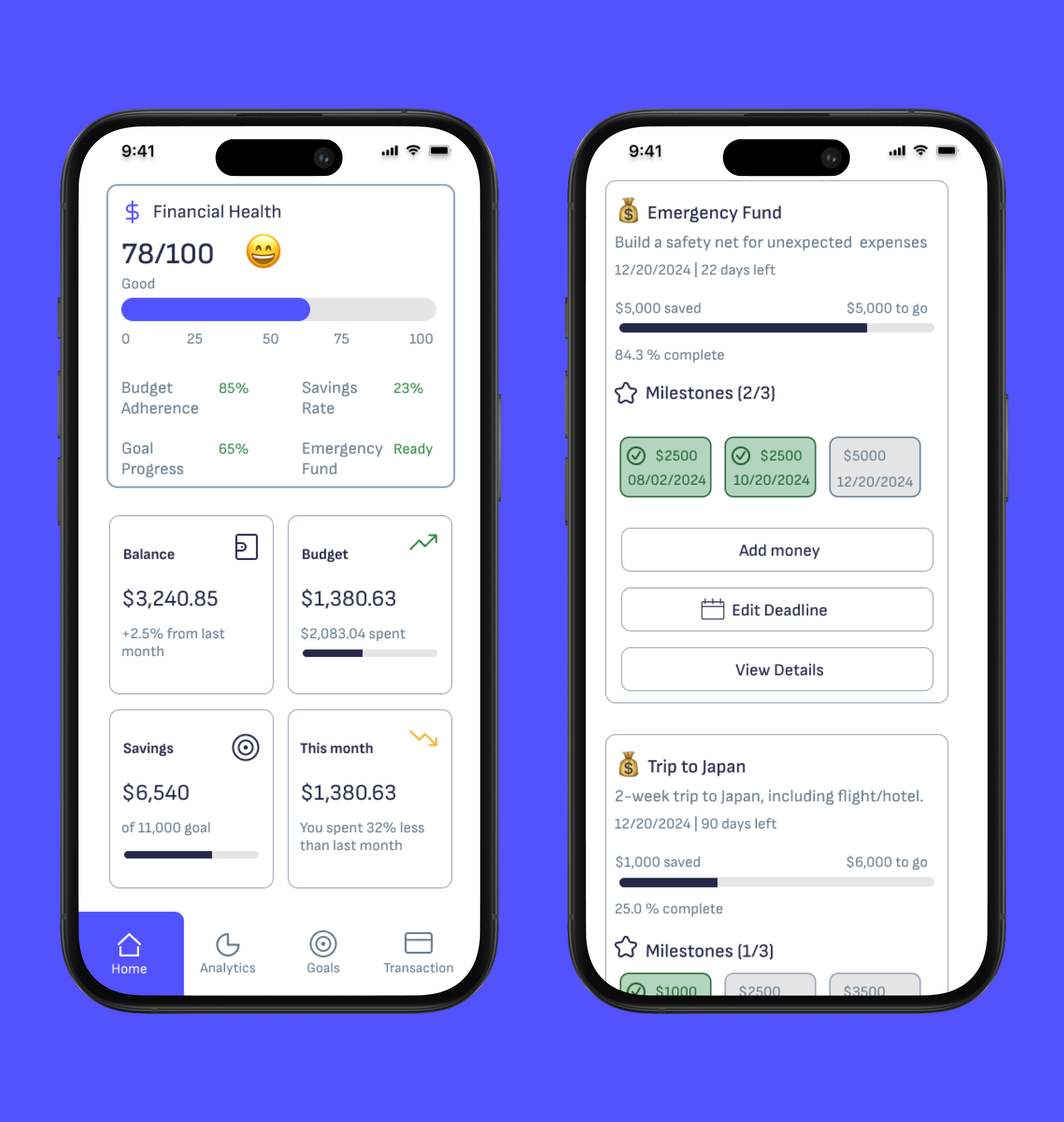

The Financial Health Dashboard

"I want to see everything in one place without hunting through screens, and I need to feel like I'm doing okay."

A consolidated financial dashboard showing overall health status, budget progress, and spending at a glance—no digging, no dense tables, just clarity.

Progress Framing + Self-Determination Theory: Reframe budgeting from "avoiding failure" to "building success." This supports autonomy and competence—two core drivers of intrinsic motivation—making users feel capable and in control rather than monitored and punished.

52% of participants reported feeling less anxious about their finances after using WalletGO. Users like Maya moved from sporadic app checking to daily engagement, citing the visual, non-punitive feedback as the key motivator.

Analytics Page

Pattern Recognition Over Number Crunching

"I see numbers in my account, but I don't understand what they mean or what to do about it."

Transform raw transaction data into actionable insights using a doughnut chart for categorical breakdown and a line graph for spending trends over time.

Cognitive Load Theory: The combination of a categorical overview (doughnut) and temporal trend (line graph) gives users multiple entry points to understand their behavior—they can answer "where does my money go?" and "is it getting better or worse?"—without cognitive overload.

Actionable Insight: Patterns enable intentional decisions. A user who sees "$300 on dining" isn't just seeing a number—they're recognizing a choice they can change.

Users who understood their spending patterns stayed engaged longer and reported feeling empowered by the data they could actually interpret.

Budgeting Goals – Motivation Through Milestones

The Long-Term Commitment Driver

"I want to save, but I don't see progress—so I give up."

Track goals by milestones with flexible contributions and positive feedback. Users set targets, see progress with bars, and get encouragement at 25%, 50%, 75%, and 100%.

Design Rationale:

The Milestone Effect: Breaking progress into small steps boosts motivation. "2 of 3 payments made" feels nearer than "67% to goal," encouraging completion.

In testing, 67% users made spending choices influenced by goal progress—skipping coffee, delaying non-essentials. Self-reports and app data confirm WalletGO’s visual feedback guides financial decisions.

Accessibility Enhancement

Color-dependent data visualization can limit accessibility for users with visual impairments or color blindness.

During usability testing, I realized that relying solely on color to communicate data in charts could exclude users with color blindness. To make the visuals more inclusive, I added unique patterns to each slice of the pie chart, allowing users to identify categories even without color cues.

For the line graph, I applied distinct marker shapes — triangles, squares, circles, and stars — to help users differentiate lines quickly. These subtle adjustments ensured that every user, regardless of visual ability, could interpret the data confidently and accurately.

Results & Reflection

67% of participants made at least one spending decision influenced by their goal progress

All participants cited the visual, non-punitive feedback as the reason they wanted to keep using the app. Most tellingly: Participants said they wanted to open the app. That's the shift from punishment to empowerment.

People don't fail at budgeting because they lack discipline.

They fail because the tools make them feel bad. By designing for emotion first—through positive reinforcement, accessible visuals, and progress-driven feedback—WalletGO transformed budgeting from a stress trigger into a confidence builder.

Maya's story isn't unique. It's the story of everyone who's felt guilty about money. WalletGO addresses that guilt by acknowledging it—and replacing it with progress.

What Next?

If I had another sprint, I’d focus on:

Diverse User Testing: Expand to freelancers to validate emotional impact and usability across income types and financial experience levels.

Financial empowerment shouldn't be one-size-fits-all. It should meet people where they are—anxious, overwhelmed, discouraged—and help them move forward at their own pace.